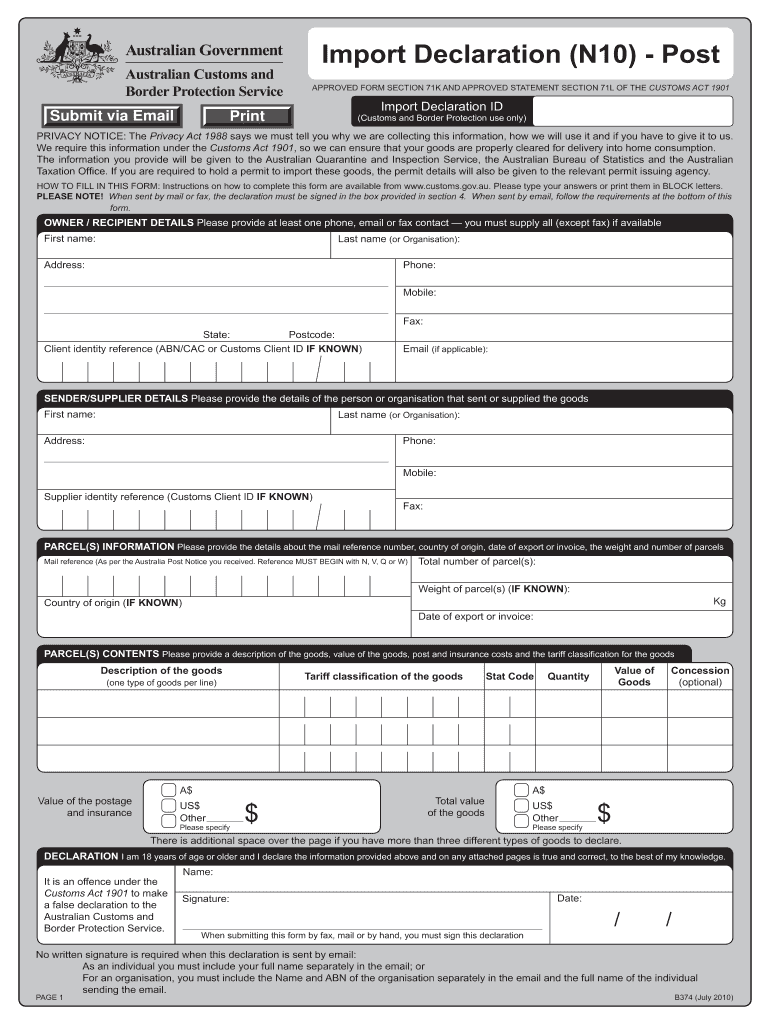

Who needs a B374 form?

This form is used by the Australian citizens to declare the goods which were bought outside the country. In most cases, the import declaration is required if the cost of the goods is above AUD$1000. The goods can be brought to the Australia in different ways: by air, sea or international mail. The Australian Customs and Border Protection Service will demand the import declaration on the customs. This type of import declaration is for goods that arrive in Australia by post.

What is the purpose of the B374 form?

The Australian Customs needs the information provided in this form to ensure that the imported goods are properly cleared for the delivery into home consumption. The data is forwarded to the Australian Quarantine and Inspection Service, the Australian Bureau of Statistics and the Australian Taxation Office. The declaration contains the details about the owner and sender (supplier) of the goods, and parcel contents.

What other documents must accompany the B374 form?

If the owner needs permission for importing certain goods, this permission form must be attached. The goods are also accompanied by Invoice form, bill of lading, insurance policy or other supporting documents.

When is the B374 form due?

This form must be completed beforehand so that the customs officer has all the relevant information.

What information should be provided in the B374 form?

- The form has the following blocks for completing:

- Details about the owner/recipient (name, address, phone number, email, Client identify reference)

- Details about the sender/supplier (name, address, phone number, Customs Client ID)

- Information about the parcel (mail reference, total number of parcels, weight, date of export or invoice, country of origin)

- Information about the parcel contents (description of the goods, tariff classification, quantity, value of the goods, concession)

- Value of the postage and insurance

- The declaring has as well to sign and date the form.

Where do I send the B374 form?

The completed Declaration form is forwarded to Customs and Border Protection Service.